Moving Average Convergence Divergence

Relative Strength Index

Money Flow Index

Commodity Channel Index

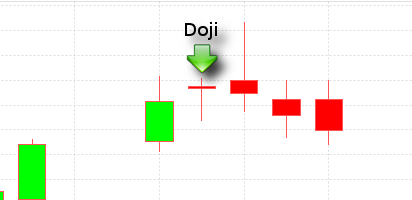

Doji

Introduction

A doji is a key trend reversal indicator.

Formula

Open price = Close price

Interpretation

The relevance of a doji depends on the preceding trend or preceding candlesticks. After an advance, or long green candlestick, a doji signals that the buying pressure is starting to weaken. After a decline, or long red candlestick, a doji signals that selling pressure is starting to diminish. Doji indicate that the forces of supply and demand are becoming more evenly matched and a change in trend may be near. Doji alone are not enough to mark a reversal and further confirmation may be warranted.

Case Study

As shown in the graph above.

The circled candle shows the reversal of trend. Doji convey a sense of indecision or tug-of-war between buyers and sellers. Prices move above and below the opening level during the session, but close at or near the opening level. The result is a standoff.

Reference

Credit

Doji pre-built indicator and tutorial are provided by Parth Khare.

English

English 中文

中文